Monday, June 15, 2020

Please

find below our latest Weekly Trend Update Report covering major

asset classes and currencies.

Have

a nice week end.

Marc

Bentin

Bentinpartner

GmbH

Trend

Status Update

Last week delivered a wake-up call with volatility returning and momentum

on the upside fading. It is too early to say whether we are heading for a relapse

or a second wave of selling but a few things are keeping us on our toes.

First and foremost, private investors (and

speculators) who were absent in March before the most powerful rebound in

history are now back “en masse” after the market has recovered most of its

losses. It is not the fact that hundreds of thousands of brokerage accounts are

being opened that has us puzzled but what this new money buys… namely bankrupted companies. Bloomberg had a brilliant story about Robinhood traders over the week end…Coupling this with seasoned

investors losing money and we get a more serious wake up call. Both Bridgewater

and Renaissance posted big losses this year, including in early June for Renaissance,

it seems. This suggests that something is really going wrong with the music of

the market (derived from the “administered” nature of financial markets). Buying

the market blindly with the sole conviction that central banks have us covered did

not work last week and may not work as well in the future either.

Investors may also have to weigh the risks of a

second wave if not of selling at least of covid cases around the world. We can

now cope better with the logistics of dealing with the virus but last week’s news

that Florida and Texas were suffering some aggravation compounded the concerns

originating from other hot spots in the world and the week end news that Beijing has recorded dozens of new cases in recent days, all linked to a major wholesale

food market. With researchers talking (and us all observing) growing evidence

of a “pandemic fatigue” and as countries reopen borders with Trump planning to

hold rallies, the temptation is real to lift our guard. This New York Doctor warning is a good wake up call as well that the virus is still

spreading and sparing no generation.

In its semi-annual report to Congress released

Friday (preceding Powell’s testimony to Congress this coming week), The Federal

Reserve put a spotlight on job losses and risks to the financial sector. “Despite increased resilience from the

financial and regulatory reforms adopted since 2008, financial system

vulnerabilities -- most notably those associated with liquidity and maturity

transformation in the nonbank financial sector -- have amplified some of the

economic effects of the pandemic,” the Fed said. “Accordingly, financial-sector

vulnerabilities are expected to be significant in the near term.”

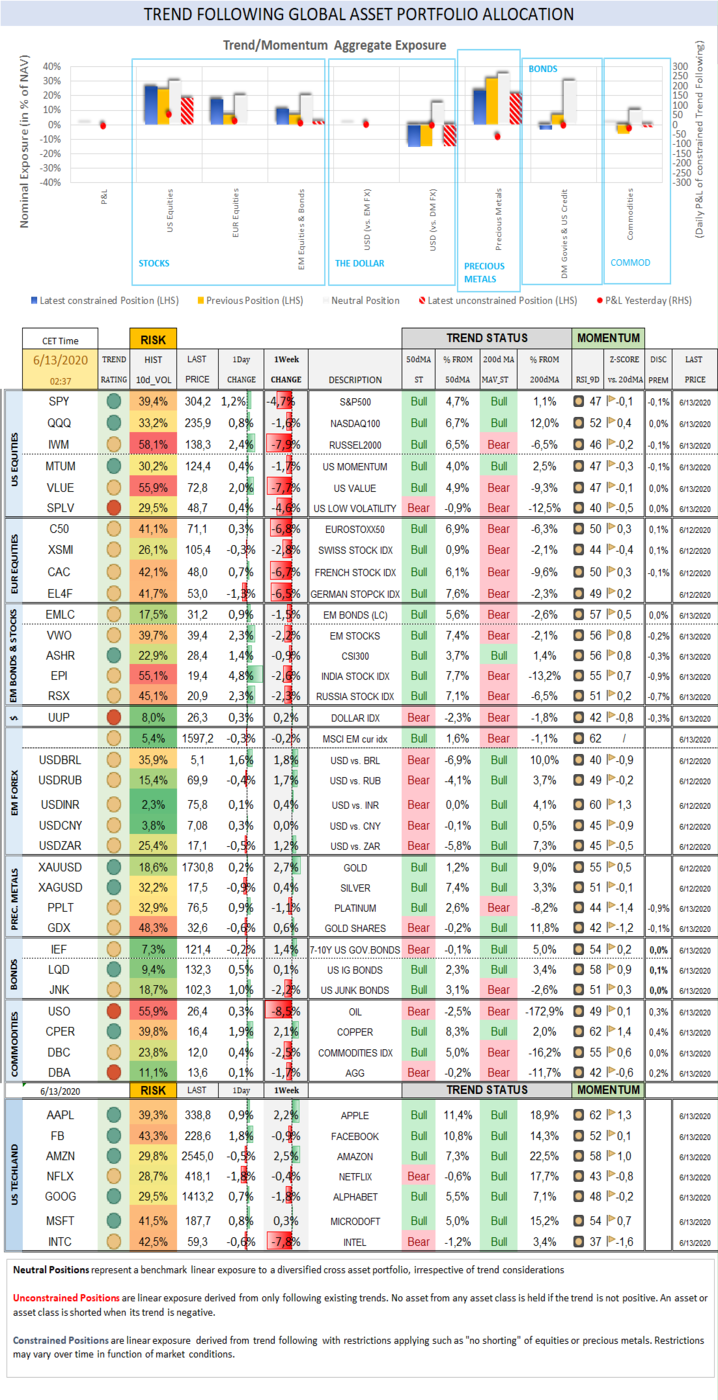

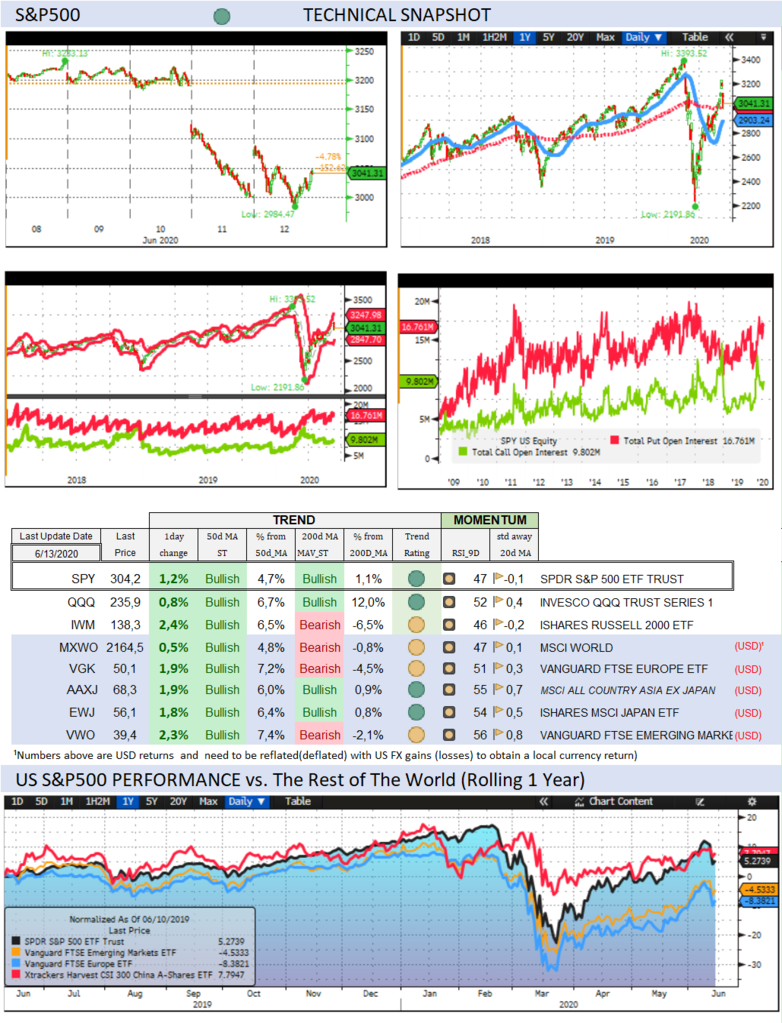

Over the past week, the S&P500 sold off by -4,7% (-5,5% YTD) while

the Nasdaq100 dropped -1,6% (10,9% YTD). The US small cap index sold off by

-7,9% (-16,5% YTD).

Cboe Volatility Index rallied 47,2% (161,9% YTD) to 36,09.

The Eurostoxx50 sold off by -6,8% (-14,5%), underperforming the

S&P500 by-2,1%.

Diversified EM equities (VWO) sold off by -2,2% (-11,4%), outperforming

the S&P500 by 2,5%.

The Dollar DXY Index (UUP) measuring the USD performance vs. other G7

currencies gained 0,2% (1,1%) while the MSCI EM currency index (measuring the

performance of EM currencies vs. the USD) dropped -0,2% (-4,1%). Over the week

end, S. Roach elaborated on his 35% dollar crash expectation (see BP read alert,

edit your distribution preferences here to start receiving these updates).

10Y US Treasuries rallied -19bps (-121bps) to 0,70%. 10Y Bunds dropped -16bps

(-25bps) to -0,44%. 10Y Italian BTPs climbed 4bps (4bps) to 1,45%,

outperforming Bunds by -2bps.

US High Yield (HY) Average Spread over Treasuries climbed 75bps (275bps)

to 6,11%. US Investment Grade Average OAS climbed 18bps (63bps) to 1,64%.

In European credit markets, EUR 5Y Senior Financial Spread climbed 15bps

(30bps) to 0,81%.

Gold rallied 2,7% (14,1%) while Silver gained 0,4% (-2,0%). Major Gold

Mines (GDX) gained 0,6% (11,5%).

Goldman Sachs Commodity Index sold off by -4,1% (-34,6%). WTI Crude sold

off by -8,3% (-40,6%).

This morning…

S&P future is ebbing back (-1.3%) with the dollar unchanged and oil slightly

lower after losing 8.3% last week (Baker Hughes showed active drilling

rigs across the U.S. falling for a 13th week to the lowest in more than a

decade).

China's business-activity report for May released this morning reflected

a slow recovery with industrial production climbing +4.4% YTD (from +5%

expected). Retail sales dropped -2.8% ytd (-2.3% expected and -7.5% in April).

Policy decisions from the BoJ (on Tuesday), BoE (on Thursday) and the SNB

(on Thursday) are due this week.

J. Powell will speak to Congress

Trend Score Card

Click here for

technical terminology.

US

& International Equities

Check out US and International Stocks’ Technical Trend

Status.

Sector

Trend & Momentum

Check equity sectors’ trend and performance …and

when they break out!

Fixed

Income

Check out 10Y US Treasury and Bund yields, their trend,

expected Fed rate moves and speculative positioning in 10-year Treasury Futures.

US Recession

Risk Radar

A comprehensive list of economic

indicators to compare the current situation with previous recessions.

The

Dollar

Check out where the Dollar stands Trendwise and Breakoutwise vs. G7 and EM counterparts.

Get the Score card of all major currency pairs in

terms of Trend, Momentum, Carry, GDP and Current account differential

Precious Metals

Check out where precious metals

stand Trendwise and Breakoutwise. Get a sense of options (cumulative

open interests on calls and puts) and futures traders’ sentiment (non-commercials

open positions).

Check out how precious metals, the dollar and the Stock

market correlate with each other and speculative futures positioning on

Gold and the Dollar.

Why Trend Following Matters and How It Can Help

You?

A disciplined and

rule-based trend following investment approach can serve as an effective

portfolio insurance technique.

To receive a Daily Trend Status

Update and round the clock market and economic instant notifications, join the

free trial for our premium research. No credit card needed.

To learn more about our premium research:

https://www.bentinpartners.ch/research

To join our free trial and choose your delivery preferences:

https://www.bentinpartners.ch/subscribe

Our Portfolio Management and Advisory Services

BentinPartner GmbH is a Swiss registered

independent financial adviser. We offer four different portfolio management

mandates:

- The “Global

Strategic” (GS) mandate invests your portfolio according to an

optimized strategic benchmark. This allocation delivers the “beta” (or markets

related) performance of your portfolio while we seek to generate additional

“alpha” (“skills related) performance with tactical adjustments, using a

predefined maximum “value at risk” envelope. Most of the portfolio’s

performance is derived from the strategic Benchmark (beta).

- The “Global

Tactical” (GT) mandate

invests your portfolio without tracking a strategic asset allocation (or

benchmark) and pursues a “total” as opposed to “relative” return objective.

With this mandate, we seek to beat the best of “cash” or of the MSCI World

Equity index, applying mostly tactical considerations,

using a

predefined maximum “value at risk” envelope and targeting not to exceed a

predetermined overall portfolio volatility.

- The “Trend/Momentum”

(TM) mandate, builds a diversified “All Weather” investment portfolio and

applies a rule-based Trend/Momentum methodology to adjust this “trend neutral”

allocation. We track trends across asset classes on a daily basis and adjust

your portfolio in a semi automatic (there is always a pilot in the plane)

fashion applying trend changes signals.

- The “Currency Overlay” (CO) mandate

seeks to generate “alpha” applying a currency overlay with a limited leverage

(not exceeding 100% of NAV). You control the portfolio allocation (which can be

a pool of cash, stocks, bonds or gold) and we manage in overlay the FX exposure

of your portfolio, seeking to add a total FX return of 4% to 7%.

For more information on our risk management and

investment methodology, please check our web site.

We deliver transparent, professional, tailor-made,

and competitive asset management services, seeking to fulfill our fiduciary

duty at all times.

Please visit our web site or call us at +41615444310.

We’d love to hear from you and see how we can further assist you.

Join us on Linked In

To be removed from the list,

please send us an email by clicking here, mentioning “unsubscribe” in

the title.

To ensure that our emails reach

your inbox and not your spam folder, please consider adding Marc.Bentin@BentinPartner.ch,

Marc.Bentin@BentinPartners.ch and our alternate address Bentinpartner@gmail.com

to your safe address book. If you are using Microsoft Outlook, simply right

click on our email address, choose "add to Outlook contacts" and then

"save".

Important Disclaimer

© Copyright by BentinPartner llc. This communication is provided for information

purposes only and for the recipient's sole use. Please do not forward it

without prior authorization. It is not intended as a recommendation, an offer

or solicitation for the purchase or sale of any security or underlying asset

referenced herein or investment advice. Investors should seek financial advice

regarding the suitability of any investment strategy based on their objectives,

financial situation, investment horizon and particular needs. This report does

not include information tailored to any particular investor. It has been

prepared without any regard to the specific investment objectives, financial

situation or particular needs of any person who receives this report. Accordingly,

the opinions discussed in this Report may not be suitable for all

investors. You should not consider any of the content in this report as legal,

tax or financial advice. The data and analysis contained herein are provided "as

is" and without warranty of any kind. BentinPartner llc, its employees, or

any third party shall not have any liability for any loss sustained by anyone

who has relied on the information contained in any publication published by

BentinPartner llc. The content and views expressed in this report represents

the opinions of Marc Bentin and should not be construed as guarantee

of performance with respect to any referenced sector. We remind you that past

performance is not necessarily indicative of future results. Although BentinPartner llc

believes the information and content included in this report have

been obtained from sources considered reliable, no representation or

warranty, express or implied, is provided in relation to the accuracy,

completeness or reliability of such information. This Report is also not

intended to be a complete statement or summary of the industries, markets or

developments referred to in the Report.

#fx #forex #investing #markets #riskmanagement

#bankingindustry #finances #money #traders #quants