Sunday, February 16, 2020

Please

find below our latest Weekly Trend Update Report covering major

asset classes and currencies.

Have

a nice week.

Marc

Bentin

Bentinpartner GmbH

Trend

Status Update

Each passing day still brings a reason to grow more concerned, if not

for the stock market, at least for the sanitary and economic impact. Last Friday,

it was that 1,700 Chinese healthcare workers that became infected (with 25,000

deployed to Hubei Province). Over the week end, it was the likelihood of being

infected more than once after being cured by its own metabolic defences or with

the help of some medicine only to get sick again with a higher probability of

heart failure. Another one is the fact that the incubation period could last

well over 2 weeks and up to 24 days without being noticed. Bill Gates warned over

the week end after donating USD100mn to fight the decease, that up to 10mn people

could die from the Corona virus with Africa particularly vulnerable, he said. For

a factual and balanced review of the Corona situation, check this week end’s article from Der Spiegel (also see The Economist Article).

For what it is worth, equities rallied to record highs just months

before the LTCM/Russia collapse in 1998. Stocks rallied to record highs in 2007

even as the mortgage finance Bubble faltered. The only difference is that interest rates are

now at zero...and that every mild equity selloff is counteracted with a presidential

tweet, a rate cut or more (non) QE or promises thereof. Anyone saying that (non)

QE and ZIRP do not ‘cause’ equity markets to rally is

just oblivious to reality. The current environment is taking risk away from the

investment equation and puts leverage at the forefront of what everybody wants

to do to escape the upcoming global monetary debasement. Nobody will tell us when the time has come to

panic (with the obvious answer being never) and leave… We are on our own.

It might be too early to judge any long term or even lasting economic impact

but China’s consumer prices rose the

fastest in more than eight years last month (CPI Food Index posted a 20.6%

y-o-y increase in January, the highest since March 2008) with ailing transport

links across the country making further gains in the coming months likely. Also, January’s China’s auto sales plunged 20.2% from

a year earlier. Specifically, “Morgan Stanley suggested that real time

measurements of Chinese pollution levels would provide a "quick and

dirty" way of observing if any of China's major metropolises had returned

back to normal. What it found was that among some of the top Chinese cities

including Guangzhou, Shanghai and Chengdu, the same pattern was evident – air

pollution was only 20-50% of the historical average”, ZH reported citing Morgan Stanley conclusion that

"This could imply that human activities such as traffic and industrial

production within/close to those cities are running 50-80% below their

potential capacity."

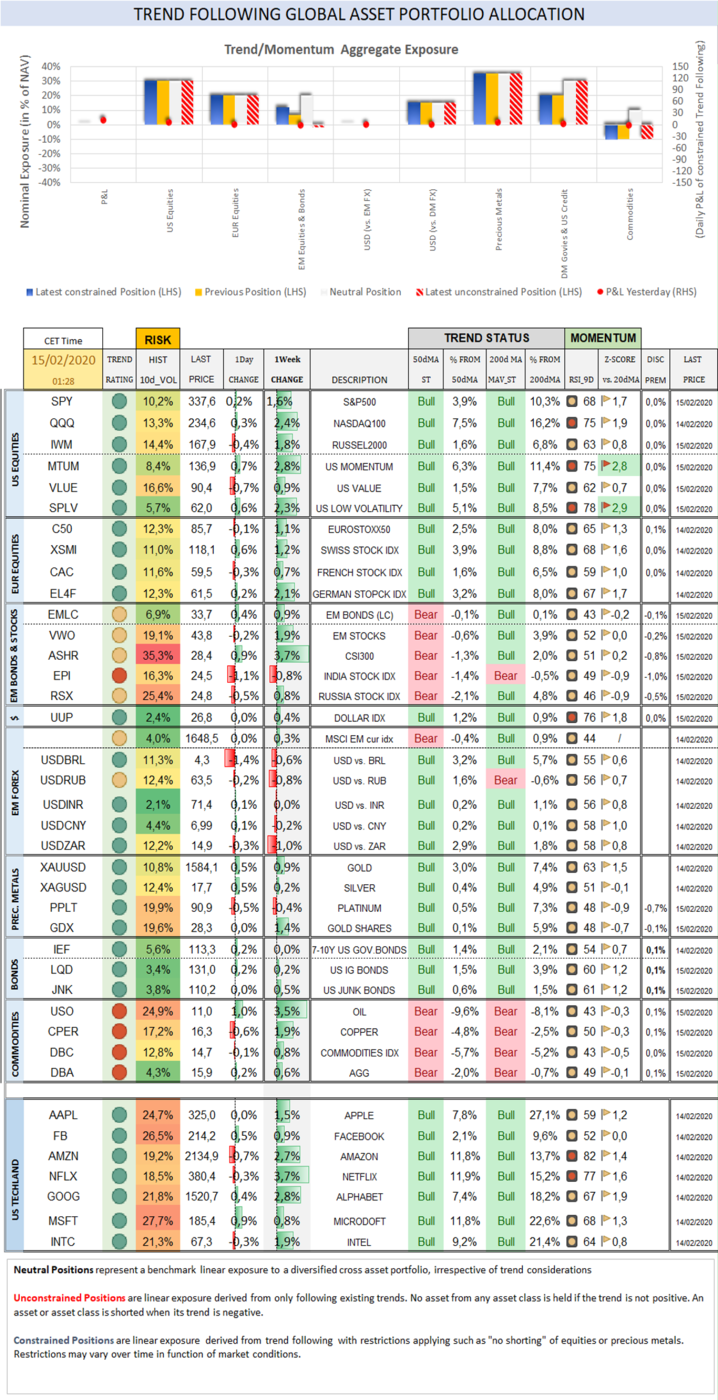

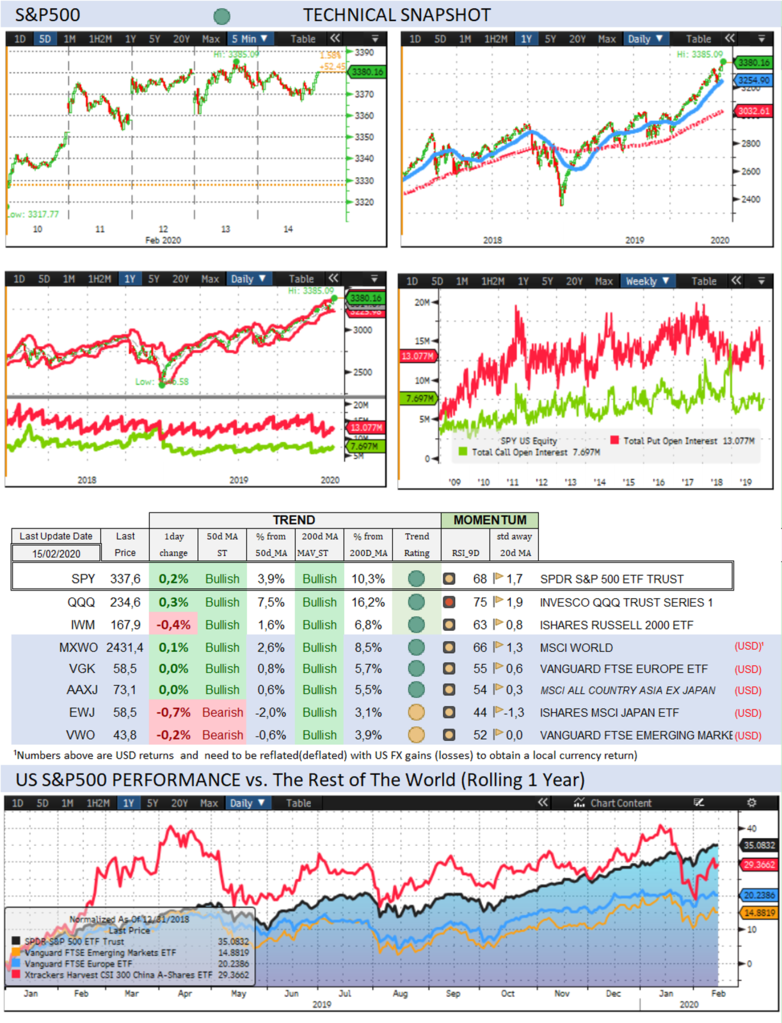

Over the past week, the S&P500 gained 1,6% (4,9% YTD) while the

Nasdaq100 rallied 2,4% (10,4% YTD). The US small cap index gained 1,8% (1,3%

YTD). CBOE Volatility Index sold off by -11,6% (-0,7% YTD) to 13,68. The

Eurostoxx50 gained 1,1% (3,1%), underperforming the S&P500 by-0,6%.

Diversified EM equities (VWO) gained 1,9% (-1,6%), underperforming the

S&P500 by 0,3%.

The Dollar DXY Index (UUP) measuring the USD performance vs. other G7

currencies gained 0,4% (3,0%) while the MSCI EM currency index (measuring the

performance of EM currencies vs. the USD) gained 0,3% (-1,0%). Over the week, the

euro weakened across the board dragged down by weaker than expected growth

numbers in Germany, negative interest rates (the biggest factor in our view when

a pair breaks lateral movements or a trend) and momentum selling after the euro

breached trend lines. EURUSD dropped -1,0% (-3,4%); EURCHF dropped -0,5%

(-2,0%); EURJPY dropped -0,9% (-2,2%); EURGBP sold off by -2,2% (-1,9%, Z-score

-2,5). It has to be said that although speculative EUR shorts remain dominant

as per last Friday’s COT report, sentiment was rather negative on the dollar going

into 2020 (from yours truly included) and that these positions and views are

being revised now. We were and remain bearish on the dollar selectively for now

vs. certain EM currencies (RUB and MXN as well) but the technical breakdown of

the euro cannot be denied and we switched to using EUR as a funding currency tactically

as well. Not everything that comes from a weaker euro is negative as the good (near

term) performance of European equity markets can attest. It will also guarantee

higher tariffs from D. Trump as the 5% tariff increase on airplanes decided on Friday

can attest. If what is left of a weaker euro is to end up on Trump’s “currency

manipulator” list, then it is not positive as it will keep detracting investors

from investing in Europe. After all, to buy GAFA’s (considered as a safe bet by

many international investors including Apple when its supply chain is totally

disrupted), you need dollars. And to build factories in the US at the expense of

European exports (say Daimler or Airbus building plants in the US), you need

dollars as well. Europe is pursuing the exact opposite strategy as China in terms

of doing its best to attract foreign capital inflicting a negative interest rates

on anyone holding its currency for no reason (only the Swiss have a legitimate

reason in our view because Switzerland has no debt and a well-functioning

economy and everybody is chasing its currency for that reason). China targets a

Fed funds +1% rate (give or take) especially for that reason of protecting the

currency and attract capital (into bonds and stocks) and it works. CNY is

holding firm despite being the epicentre of the corona virus outbreak. Demand

for Treasuries and HY bonds is returning, as opposed to demand for European

bonds (by foreigners). That obviously excludes Greek government bonds whose 10-year

yields dropped below 1% (without being yet eligible for ECB buying which might still

be forthcoming…).

10Y US Treasuries were unchanged on the week (-33bps ytd)

to 1,58%. 10Y Bunds dropped -2bps (-22bps) to -0,40%. 10Y Italian BTPs dropped

-2bps (-49bps) to 0,92%.

US High Yield (HY) Average Spread over Treasuries dropped -10bps (8bps)

to 3,44%. US Investment Grade Average OAS climbed 0bps (5bps) to 1,06%.

In European credit markets, EUR 5Y Senior Financial Spread dropped -2bps

(-4bps) to 0,47%. Lebanon’s foreign debt sank to a record low as speculation

mounted that the government may not repay a $1.2 billion Eurobond due in less

than a month. Investors are pondering what shape a default might take.

Gold gained 0,9% (4,4%) while Silver gained 0,2% (-0,6%). Major Gold

Mines (GDX) gained 1,4% (-3,3%). As we stated before, we share Ray Dalio’s opinion expressed in Davos that ‘cash is thrash’ …with

the caveat perhaps that the more you have of it, the better. Looking at the

price of everything, hard or financial, cash is losing its “interest” and value

as a store of value. This is one way of reading the ongoing joint runaway rally

in equity markets that defy dimming economic prospects (and high valuation) and

the all-round appreciation of the precious metals’ complex. Cash will persist as

a mean of payment to buy anything more tangible than paper and ink. It will also persist as a unit of account to

calculate the speed at which cash is (and will be) losing its value vs. hard

assets and financial asset as well. One caveat perhaps has been the reported decline

in physical demand coming from China. However, and to the extent that the

nominal outstanding in gold backed ETF’s reached fresh highs last week, chances

are that investors’ demand continues unabated. As a recent report from Degussa showed, ETF outstanding holdings seem to be the head that leads the tail for global

investment demand and price, perhaps more so than physical demand. The fact

that ETF outstanding (and demand) has recently exceeded that of its previous

peak in 2012 (while the price of gold at least in USD is still well short of

its previous all-time highs) suggests that ETF flows may be a leading rather

than lagging or worse contrarian indicator of gold price performance.

As regards the Chinese physical demand itself, we do not see the reason

why investors would reduce their purchases of gold on a lasting basis except if

they cannot go shopping for much longer and also because there is a time tested

pattern suggesting that Asians are reluctant buyers of gold at historical highs

which is where it is trading against many currencies including their own.

Goldman Sachs Commodity Index gained 1,9% (-9,9%). WTI Crude rallied

3,4% (-14,8%). OPEC slashed its oil demand forecast last week, and Goldman

Sachs doubled down on its bearish oil take cutting its oil price target by $10

to $53 for the year, as a result of a "demand shock" that is set to

collapse Chinese oil consumption by 20%, or as much as 4 million barrels per

day, the report said.

Over the week end…

China pledged to roll out more effective stimulus despite a widening

fiscal gap as the novel coronavirus hits an already slowing economy,

highlighting the challenges the epidemic is imposing as the death toll stacks

up and thousands of new cases are reported each day, Bloomberg reported.

As EU leaders are set for a summit next week French

President E. Macron urged the EU, and Germany in particular, not to

let the debate over the bloc’s budget distract them from their real challenges,

calling on them to step up investment in technologies of the future like 5G

networks, cloud-computing and artificial intelligence. He questioned the

validity of debating whether the next seven-year budget should be 1% or 1.1% of

the bloc’s GDP. “The (current) policy mix is mad in an environment

in which borrowing costs are essentially zero”, he said.

President Donald Trump’s top energy official said

he’s confident that Russia won’t be able to complete the Nord Stream 2 gas

pipeline in the Baltic Sea -- and signalled that the U.S. will press forward

with its opposition to the project. Trump has assailed Germany for giving

“billions” to Russia for gas while it benefits from U.S. protection. Even as he

spoke, signs emerged that Gazprom’s attempts at completion may be underway.

Elon Musk’s plan to build an electric car plant in

Germany has run into legal trouble after a court said clearing a forest near

Berlin for a new Tesla factory must stop immediately.

Boris Johnson is preparing to dismiss demands by

Brussels for the UK to abide by EU rules on tax and workers' rights after

Brexit, The Telegraph reported.

Japan will report Q4 GDP today, likely showing a

-1% QoQ decline (from +0.4% previously) as the

country takes the hit from the corona virus.

Trend Score Card

Click here for technical annotations.

US

& International Equities

Check out US and International Stocks’ Technical

Trend Status.

Sector

Trend & Momentum

Check equity sectors’ trend and performance …and when

they break out!

Fixed

Income

Check out 10Y US Treasury and Bund yields, their

trend, expected Fed rate moves and speculative positioning in 10-year Treasury

Futures.

US Recession

Risk Radar

A comprehensive list of

economic indicators to compare the current situation with previous recessions.

The

Dollar

Check out where the Dollar stands Trendwise and Breakoutwise vs. G7

and EM counterparts.

Precious Metals

Check out where precious

metals stand Trendwise

and Breakoutwise.

Get a sense of options (cumulative open interests on calls and puts) and futures

traders’ sentiment (non-commercials open positions).

Why Trend Following Matters and How It Can Help

You?

A disciplined and rule-based

trend following investment approach can serve as an effective portfolio

insurance technique.

To receive a Daily Trend

Status Update and round the clock market and economic instant notifications, join the

free trial for our premium research. No credit card needed.

To learn more about our premium research:

https://www.bentinpartners.ch/research

To join our free trial and choose your delivery preferences:

https://www.bentinpartners.ch/subscribe

Our Portfolio Management and Advisory Services

BentinPartner GmbH is a

Swiss registered independent financial adviser. We offer four different

portfolio management mandates:

- The “Global

Strategic” (GS) mandate invests your portfolio according to an

optimized strategic benchmark. This allocation delivers the “beta” (or markets

related) performance of your portfolio while we seek to generate additional

“alpha” (“skills related) performance with tactical adjustments, using a

predefined maximum “value at risk” envelope. Most of the portfolio’s

performance is derived from the strategic Benchmark (beta).

- The “Global

Tactical” (GT) mandate

invests your portfolio without tracking a strategic asset allocation (or benchmark)

and pursues a “total” as opposed to “relative” return objective. With this

mandate, we seek to beat the best of “cash” or of the MSCI World Equity index,

applying mostly tactical considerations,

using a

predefined maximum “value at risk” envelope and targeting not to exceed a

predetermined overall portfolio volatility.

- The “Trend/Momentum”

(TM) mandate, builds a diversified “All Weather” investment portfolio and

applies a rule-based Trend/Momentum methodology to adjust this “trend neutral”

allocation. We track trends across asset classes on a daily basis and adjust

your portfolio in a semi automatic (there is always a pilot in the plane)

fashion applying trend changes signals.

- The “Currency Overlay” (CO) mandate

seeks to generate “alpha” applying a currency overlay with a limited leverage

(not exceeding 100% of NAV). You control the portfolio allocation (which can be

a pool of cash, stocks, bonds or gold) and we manage in overlay the FX exposure

of your portfolio, seeking to add a total FX return of 4% to 7%.

For more information on our risk management and

investment methodology, please check our web site.

We deliver transparent, professional, tailor-made,

and competitive asset management services, seeking to fulfill our fiduciary

duty at all times.

Please visit our web site or call us at

+41615444310. We’d love to hear from you and see how we can further assist you.

Join us on Linked In

To be removed from the

list, please send us an email by clicking here, mentioning “unsubscribe”

in the title.

To ensure that our emails

reach your inbox and not your spam folder, please consider adding

Marc.Bentin@BentinPartner.ch, Marc.Bentin@BentinPartners.ch and our alternate

address Bentinpartner@gmail.com to your safe address book. If you are using

Microsoft Outlook, simply right click on our email address, choose "add to

Outlook contacts" and then "save".

Important Disclaimer

© Copyright by BentinPartner llc.

This communication is provided for information purposes only and for the recipient's

sole use. Please do not forward it without prior authorization. It is not

intended as a recommendation, an offer or solicitation for the purchase or sale

of any security or underlying asset referenced herein or investment advice.

Investors should seek financial advice regarding the suitability of any investment

strategy based on their objectives, financial situation, investment horizon and

particular needs. This report does not include information tailored to any

particular investor. It has been prepared without any regard to the specific

investment objectives, financial situation or particular needs of any person

who receives this report. Accordingly, the opinions discussed in this

Report may not be suitable for all investors. You should not consider any of

the content in this report as legal, tax or financial advice. The data and analysis

contained herein are provided "as is" and without warranty of any

kind. BentinPartner llc, its

employees, or any third party shall not have any liability for any loss

sustained by anyone who has relied on the information contained in any

publication published by BentinPartner llc. The content and views expressed in this report

represents the opinions of Marc Bentin and should not be construed as

guarantee of performance with respect to any referenced sector. We remind you

that past performance is not necessarily indicative of future results. Although

BentinPartner llc believes

the information and content included in this report have been obtained from

sources considered reliable, no representation or warranty, express or

implied, is provided in relation to the accuracy, completeness or reliability

of such information. This Report is also not intended to be a complete

statement or summary of the industries, markets or developments referred to in

the Report.

#fx #forex #investing

#markets #riskmanagement #bankingindustry

#finances #money #traders #quants